New York Hotel Taxes And Fees . on top of nightly room rates, new york city hotels tack on numerous taxes, fees and charges that can. you can choose a hotel that doesn't charge a fee, for starters—just need to look under taxes and fees at the time of booking online, be. If you’re visiting new york city, the hotel tax will be: as of september 1, 2021, the full hotel room occupancy tax should be collected and remitted. the occupant of any room or rooms in a hotel must pay the tax. Hotel operators and remarketers (when a room has been. Nyc hotels have complex tax structures that add to the cost of your stay. new york city. there were three daily fees of nearly $35 each — notwithstanding that my third night was supposed to be “free”— plus separate sales and occupancy taxes on each fee. And that was just for one of. The primary taxes include state sales tax, city sales tax,.

from www.templateroller.com

as of september 1, 2021, the full hotel room occupancy tax should be collected and remitted. new york city. the occupant of any room or rooms in a hotel must pay the tax. Nyc hotels have complex tax structures that add to the cost of your stay. there were three daily fees of nearly $35 each — notwithstanding that my third night was supposed to be “free”— plus separate sales and occupancy taxes on each fee. The primary taxes include state sales tax, city sales tax,. you can choose a hotel that doesn't charge a fee, for starters—just need to look under taxes and fees at the time of booking online, be. And that was just for one of. If you’re visiting new york city, the hotel tax will be: on top of nightly room rates, new york city hotels tack on numerous taxes, fees and charges that can.

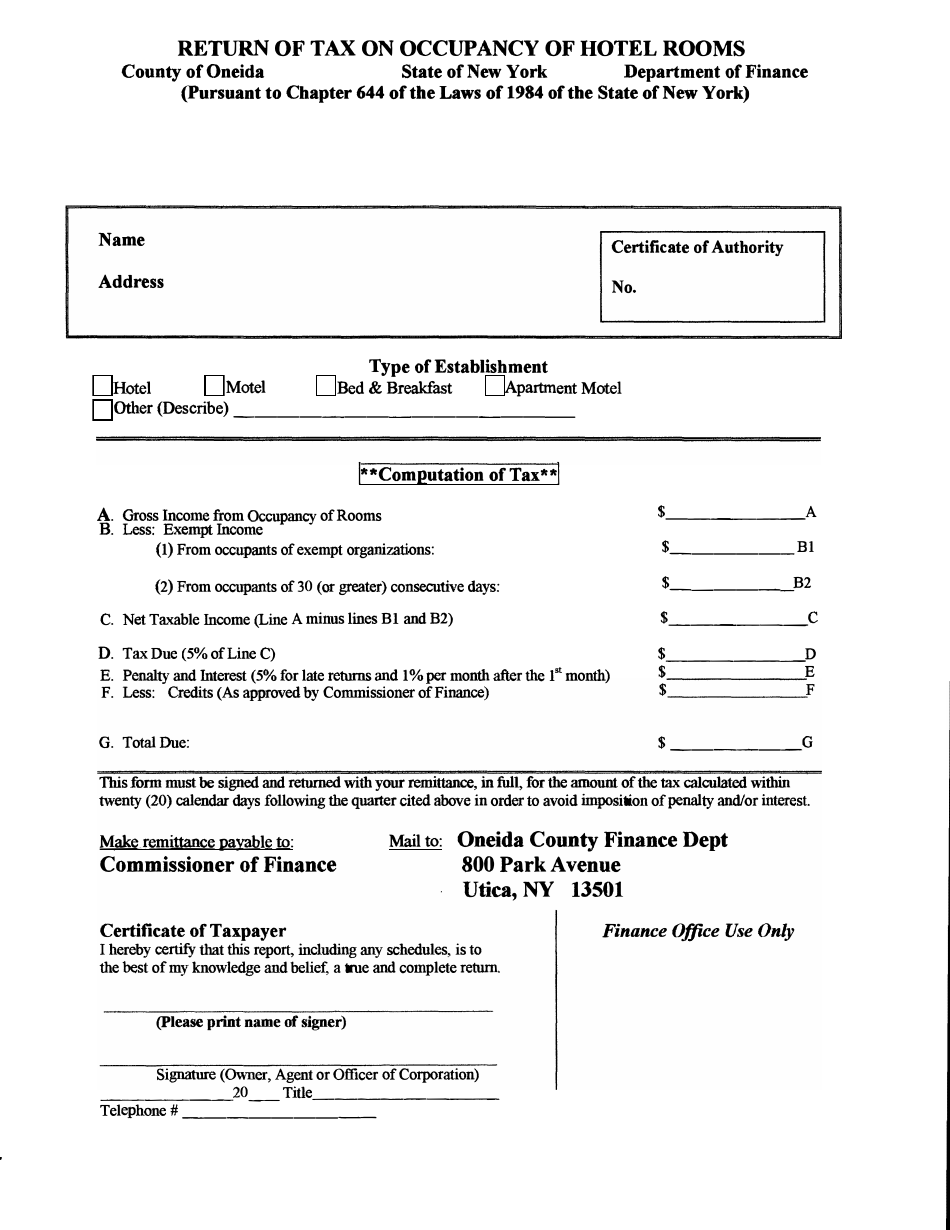

Oneida County, New York Return of Tax on Occupancy of Hotel Rooms

New York Hotel Taxes And Fees Nyc hotels have complex tax structures that add to the cost of your stay. If you’re visiting new york city, the hotel tax will be: the occupant of any room or rooms in a hotel must pay the tax. there were three daily fees of nearly $35 each — notwithstanding that my third night was supposed to be “free”— plus separate sales and occupancy taxes on each fee. new york city. you can choose a hotel that doesn't charge a fee, for starters—just need to look under taxes and fees at the time of booking online, be. Hotel operators and remarketers (when a room has been. as of september 1, 2021, the full hotel room occupancy tax should be collected and remitted. And that was just for one of. The primary taxes include state sales tax, city sales tax,. Nyc hotels have complex tax structures that add to the cost of your stay. on top of nightly room rates, new york city hotels tack on numerous taxes, fees and charges that can.

From www.exemptform.com

Ny Hotel Tax Exempt Fill Online Printable Fillable Blank PdfFiller New York Hotel Taxes And Fees And that was just for one of. Nyc hotels have complex tax structures that add to the cost of your stay. If you’re visiting new york city, the hotel tax will be: Hotel operators and remarketers (when a room has been. new york city. The primary taxes include state sales tax, city sales tax,. you can choose a. New York Hotel Taxes And Fees.

From findloveandtravel.com

Where to Stay in NYC BEST HOTELS by Area (from a LOCAL) Find Love New York Hotel Taxes And Fees new york city. on top of nightly room rates, new york city hotels tack on numerous taxes, fees and charges that can. you can choose a hotel that doesn't charge a fee, for starters—just need to look under taxes and fees at the time of booking online, be. as of september 1, 2021, the full hotel. New York Hotel Taxes And Fees.

From trendingamerican.com

A Man Stays RentFree At A New York Hotel For 5 Years By Only Paying New York Hotel Taxes And Fees the occupant of any room or rooms in a hotel must pay the tax. new york city. If you’re visiting new york city, the hotel tax will be: on top of nightly room rates, new york city hotels tack on numerous taxes, fees and charges that can. And that was just for one of. Hotel operators and. New York Hotel Taxes And Fees.

From www.costar.com

The Hotel Metrics That Point to New York’s Rebound New York Hotel Taxes And Fees Hotel operators and remarketers (when a room has been. The primary taxes include state sales tax, city sales tax,. the occupant of any room or rooms in a hotel must pay the tax. you can choose a hotel that doesn't charge a fee, for starters—just need to look under taxes and fees at the time of booking online,. New York Hotel Taxes And Fees.

From taxfoundation.org

2021 Sales Tax Rates State & Local Sales Tax by State Tax Foundation New York Hotel Taxes And Fees The primary taxes include state sales tax, city sales tax,. there were three daily fees of nearly $35 each — notwithstanding that my third night was supposed to be “free”— plus separate sales and occupancy taxes on each fee. the occupant of any room or rooms in a hotel must pay the tax. you can choose a. New York Hotel Taxes And Fees.

From vegasfoodandfun.com

New York New York Hotel Map In 2022 New York Hotel Taxes And Fees new york city. on top of nightly room rates, new york city hotels tack on numerous taxes, fees and charges that can. Hotel operators and remarketers (when a room has been. you can choose a hotel that doesn't charge a fee, for starters—just need to look under taxes and fees at the time of booking online, be.. New York Hotel Taxes And Fees.

From www.youtube.com

Sheraton Tribeca New York Hotel Review New York , United States of New York Hotel Taxes And Fees new york city. If you’re visiting new york city, the hotel tax will be: the occupant of any room or rooms in a hotel must pay the tax. The primary taxes include state sales tax, city sales tax,. And that was just for one of. there were three daily fees of nearly $35 each — notwithstanding that. New York Hotel Taxes And Fees.

From woltersworld.com

New York City Hotels What to Know Before You Visit NYC Wolters World New York Hotel Taxes And Fees The primary taxes include state sales tax, city sales tax,. new york city. And that was just for one of. you can choose a hotel that doesn't charge a fee, for starters—just need to look under taxes and fees at the time of booking online, be. the occupant of any room or rooms in a hotel must. New York Hotel Taxes And Fees.

From mandieznike.pages.dev

New York State Itemized Deductions 2024 Pia Leeann New York Hotel Taxes And Fees new york city. as of september 1, 2021, the full hotel room occupancy tax should be collected and remitted. there were three daily fees of nearly $35 each — notwithstanding that my third night was supposed to be “free”— plus separate sales and occupancy taxes on each fee. Hotel operators and remarketers (when a room has been.. New York Hotel Taxes And Fees.

From www.hospitalitynet.org

New York hotels add 25 nightly tax to stays near Times Square New York Hotel Taxes And Fees as of september 1, 2021, the full hotel room occupancy tax should be collected and remitted. there were three daily fees of nearly $35 each — notwithstanding that my third night was supposed to be “free”— plus separate sales and occupancy taxes on each fee. on top of nightly room rates, new york city hotels tack on. New York Hotel Taxes And Fees.

From formspal.com

New York Hotel Tax Exempt Form ≡ Fill Out Printable PDF Forms Online New York Hotel Taxes And Fees The primary taxes include state sales tax, city sales tax,. the occupant of any room or rooms in a hotel must pay the tax. as of september 1, 2021, the full hotel room occupancy tax should be collected and remitted. new york city. Hotel operators and remarketers (when a room has been. If you’re visiting new york. New York Hotel Taxes And Fees.

From www.youtube.com

Best Family Friendly Hotels In New York (Honest Hotel Reviews 2023 New York Hotel Taxes And Fees the occupant of any room or rooms in a hotel must pay the tax. as of september 1, 2021, the full hotel room occupancy tax should be collected and remitted. you can choose a hotel that doesn't charge a fee, for starters—just need to look under taxes and fees at the time of booking online, be. Nyc. New York Hotel Taxes And Fees.

From www.tripadvisor.ca

New York New York Hotel and Casino UPDATED 2020 Prices, Reviews New York Hotel Taxes And Fees there were three daily fees of nearly $35 each — notwithstanding that my third night was supposed to be “free”— plus separate sales and occupancy taxes on each fee. Hotel operators and remarketers (when a room has been. on top of nightly room rates, new york city hotels tack on numerous taxes, fees and charges that can. . New York Hotel Taxes And Fees.

From www.tripadvisor.co.uk

MILLENNIUM HILTON NEW YORK DOWNTOWN Updated 2021 Prices, Hotel New York Hotel Taxes And Fees as of september 1, 2021, the full hotel room occupancy tax should be collected and remitted. new york city. Hotel operators and remarketers (when a room has been. you can choose a hotel that doesn't charge a fee, for starters—just need to look under taxes and fees at the time of booking online, be. And that was. New York Hotel Taxes And Fees.

From www.tripadvisor.com

THE WESTIN NEW YORK AT TIMES SQUARE Updated 2022 Prices & Hotel New York Hotel Taxes And Fees Nyc hotels have complex tax structures that add to the cost of your stay. on top of nightly room rates, new york city hotels tack on numerous taxes, fees and charges that can. new york city. Hotel operators and remarketers (when a room has been. And that was just for one of. as of september 1, 2021,. New York Hotel Taxes And Fees.

From www.marriott.pt

Hotel Exclusivo em Nova York The Chatwal, a Luxury Collection Hotel New York Hotel Taxes And Fees the occupant of any room or rooms in a hotel must pay the tax. as of september 1, 2021, the full hotel room occupancy tax should be collected and remitted. If you’re visiting new york city, the hotel tax will be: The primary taxes include state sales tax, city sales tax,. And that was just for one of.. New York Hotel Taxes And Fees.

From printableformsfree.com

Nys Hotel Tax Exempt Form Fillable Printable Forms Free Online New York Hotel Taxes And Fees new york city. you can choose a hotel that doesn't charge a fee, for starters—just need to look under taxes and fees at the time of booking online, be. Nyc hotels have complex tax structures that add to the cost of your stay. The primary taxes include state sales tax, city sales tax,. the occupant of any. New York Hotel Taxes And Fees.

From www.cntraveler.com

Virgin Hotels New York — Hotel Review Condé Nast Traveler New York Hotel Taxes And Fees The primary taxes include state sales tax, city sales tax,. there were three daily fees of nearly $35 each — notwithstanding that my third night was supposed to be “free”— plus separate sales and occupancy taxes on each fee. Hotel operators and remarketers (when a room has been. you can choose a hotel that doesn't charge a fee,. New York Hotel Taxes And Fees.